Sharepoint library and Word integration

Hi,

I have a SharePoint 2010 document library that contains, amongst others, the following fields.

[Decision 1]

[Decision 1 Date]

[Decision 1 Explination]

[Decision 2]

[Decision 2 Date]

[Decision 2 Explination]

[Decision 3]

[Decision 3 Date]

[Decision 3 Explination]

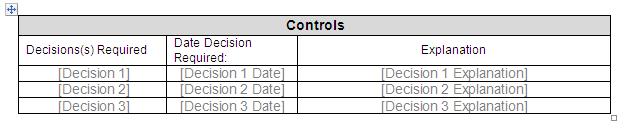

Now those fields are populated into the Word document upon opening it, via templating and using the insertion of Quickparts for each field, as shown below..

Can anyone explain how I could have the Row of the Table that contains [Decision 2] and [Decision 3] collapsed, removed, invisible, when there is no text contained in those two QuickParts?

Hope so as the doc looks a mess as it is :(

I have a SharePoint 2010 document library that contains, amongst others, the following fields.

[Decision 1]

[Decision 1 Date]

[Decision 1 Explination]

[Decision 2]

[Decision 2 Date]

[Decision 2 Explination]

[Decision 3]

[Decision 3 Date]

[Decision 3 Explination]

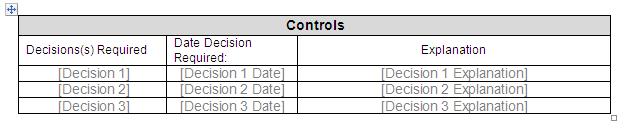

Now those fields are populated into the Word document upon opening it, via templating and using the insertion of Quickparts for each field, as shown below..

Can anyone explain how I could have the Row of the Table that contains [Decision 2] and [Decision 3] collapsed, removed, invisible, when there is no text contained in those two QuickParts?

Hope so as the doc looks a mess as it is :(

ASKER CERTIFIED SOLUTION

membership

This solution is only available to members.

To access this solution, you must be a member of Experts Exchange.

ASKER

Thanks