Interest calculation...

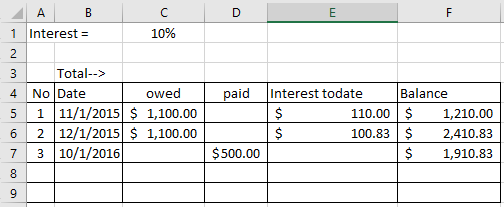

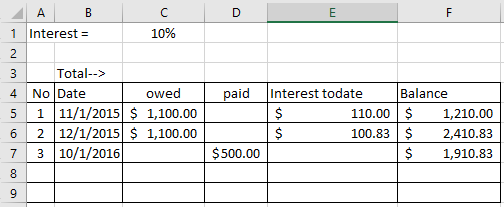

Sheet 1 of the attached Excel file has 6 columns.

- The formula used for column E ("Interest todate") is: =(owed amount*interest rate)*(number of months)/12

Q1: How can I change it to calculate in daily basis?

- Item 3 ($500) paid on 10/1/2016 produces balance of $1,910.83

Q2: How to prepare this sheet upon future payments (say $600 on 11/1/2016, the balance amount to show up automatically.

Basically, columns E and F need to be automatically updated when a new entry in Columns C or D is made. These columns will not be updated for the same date.

Thank you

Payment_a.xlsx

- The formula used for column E ("Interest todate") is: =(owed amount*interest rate)*(number of months)/12

Q1: How can I change it to calculate in daily basis?

- Item 3 ($500) paid on 10/1/2016 produces balance of $1,910.83

Q2: How to prepare this sheet upon future payments (say $600 on 11/1/2016, the balance amount to show up automatically.

Basically, columns E and F need to be automatically updated when a new entry in Columns C or D is made. These columns will not be updated for the same date.

Thank you

Payment_a.xlsx

SOLUTION

membership

This solution is only available to members.

To access this solution, you must be a member of Experts Exchange.

ASKER CERTIFIED SOLUTION

membership

This solution is only available to members.

To access this solution, you must be a member of Experts Exchange.

ASKER

Thank you.

ASKER

Thank you for the reply. To answer your question, it is new amount.

I am downloading your file now to check it out.

Mike