Sara Hedtler

asked on

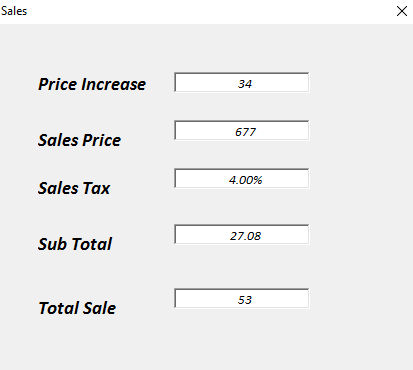

Calculating Sales Tax

I've tried to create a Form to Calculate Sales and Taxes, but I'm not able to get the form to work. Super new to vba, off and on for a few years and its now become imperative for me to get this done. This is the code i have so far.

Private Sub txtSalesTax_Change()

Me.txtSubtotal.Text = Val(Replace(txtSalesPrice.

End Sub

Private Sub txtSubtotal_AfterUpdate()

Me.txtSubtotal.Value = Format(txtSubtotal.Text, "$0,00")

End Sub

Private Sub txtSalesTax_AfterUpdate()

Me.txtSalesTax.Text = Val(txtSalesTax.Value) / 100

Me.txtSalesTax.Text = Format(txtSalesTax, "Percent")

End Sub

Private Sub txtTotalSale_Values()

Dim dbltxtTotalSale As Double

On Error Resume Next

dbltxtTotalSale = CDbl(txtSubtotal.Value)

dbltxtTotalSale = dbltxtSubtotal + CDbl(PriceIncrease.Value) - CDbl(txtSubtotal.Value)

dbltxtTotalSale = dbltxtTotalSale + CDbl(PriceIncrease.Value)

txtTotalSale.Value = dbltxtTotalSale

txtTotalSale = Format(txtTotalSale, "$0.00")

End Sub

Private Sub txtSalesTax_Change()

Me.txtSubtotal.Text = Val(Replace(txtSalesPrice.

End Sub

Private Sub txtSubtotal_AfterUpdate()

Me.txtSubtotal.Value = Format(txtSubtotal.Text, "$0,00")

End Sub

Private Sub txtSalesTax_AfterUpdate()

Me.txtSalesTax.Text = Val(txtSalesTax.Value) / 100

Me.txtSalesTax.Text = Format(txtSalesTax, "Percent")

End Sub

Private Sub txtTotalSale_Values()

Dim dbltxtTotalSale As Double

On Error Resume Next

dbltxtTotalSale = CDbl(txtSubtotal.Value)

dbltxtTotalSale = dbltxtSubtotal + CDbl(PriceIncrease.Value) - CDbl(txtSubtotal.Value)

dbltxtTotalSale = dbltxtTotalSale + CDbl(PriceIncrease.Value)

txtTotalSale.Value = dbltxtTotalSale

txtTotalSale = Format(txtTotalSale, "$0.00")

End Sub

the line below looks weird...

if the SalesTax is based on Subtotal, you can update the SalesTax in txtSubtotal_AfterUpdate() event.

like:

Me.txtSalesTax.Text = Val(txtSalesTax.Value) / 100if the SalesTax is based on Subtotal, you can update the SalesTax in txtSubtotal_AfterUpdate() event.

like:

Private Sub txtSubtotal_AfterUpdate()

Me.txtSubtotal.Value = Format(txtSubtotal.Text, "$0,00")

Me.txtSalesTax.Text = Format(txtSalesTax, "Percent")

End Sub

Private Sub txtSalesTax_AfterUpdate()

End SubASKER

Thank you! I've attached the workbook to see.

ASKER

I thought i had attached it, but apparently not.

sales---tax.xlsm

sales---tax.xlsm

ASKER

It wasn't working for me. Not sure if I was using the right code.

yea, it may not worked at this moment, but can you tell us the logic of calculations so we can build the right codes

ASKER

I think i almost have it, its just the totals not working. sales---tax--revised-5-5-17.xlsm

can you tell us the logic behind the calculation of Total Sale?

we can't just guess what you needed.

we can't just guess what you needed.

ASKER

I need the total to calculate from Subtotal, Sales Price and Price Increase to sum.

if you have:

Price Increase : $20.00

Sales Price: $100.00

Sales Tax: 3.00%

Sub Total: $3.60

what is the expected Total Sale?

Price Increase : $20.00

Sales Price: $100.00

Sales Tax: 3.00%

Sub Total: $3.60

what is the expected Total Sale?

ASKER

$123.60

ASKER CERTIFIED SOLUTION

membership

This solution is only available to members.

To access this solution, you must be a member of Experts Exchange.

Could you please outline your process a little more?

For example, which text boxes are you allowing users to enter data into? Which ones are locked? Do you have any other controls on the form? Is your form bound to a table or recordset?

-Tala-